The Keltner Channel is a powerful tool for trend-following traders. It adapts to price movement and volatility, helping traders identify and stay in high-probability directional moves. This guide explains a complete Keltner Channel trend-following strategy with rules you can apply across multiple markets.

Why Use Keltner Channel for Trend Trading?

The indicator provides:

- A clear view of trend direction using the EMA

- Dynamic volatility bands to guide trade entries and exits

- A framework for setting tight stop-losses and trailing profits

It works especially well when combined with price structure and momentum filters.

Ideal Timeframes for Trend-Following

- 15-minute or 1-hour (intraday)

- 4-hour or daily (swing trading)

- Weekly (position trading)

Choose a timeframe based on your preferred holding duration.

Recommended Keltner Channel Settings

- EMA: 20

- ATR: 10 to 14

- Multiplier: 2

These values offer a balanced channel suitable for most trending markets.

Keltner Channel Trend-Following Rules

1. Identify the Trend

- If price stays above the EMA and channels slope upward → uptrend

- If price remains below the EMA and channels slope downward → downtrend

Confirm with:

- Higher highs and higher lows (for uptrend)

- Lower highs and lower lows (for downtrend)

2. Entry Method

- Wait for a pullback to the middle EMA line

- Enter when price resumes in the trend direction with a strong candle

- Optional: confirm with RSI above 50 (uptrend) or below 50 (downtrend)

3. Stop-Loss and Exit

- Place stop-loss just outside the opposite band

- Exit partially at the outer band, or use a trailing stop behind the EMA

- For long trends, ride the move until price closes inside the opposite band

Example Setup (Long Trade)

- Daily chart shows clear uptrend in a stock

- Price pulls back to the EMA line

- Strong bullish candle closes near upper band

- Enter long with stop below lower band

- Exit half at upper band and trail the rest using the EMA

Tips for Trend-Following Success

- Avoid entering during wide consolidations

- Don’t fight the trend — trade only in the dominant direction

- Use volume confirmation for stronger conviction

- Let winners run using trailing exits

Final Thoughts

The Keltner Channel trend-following strategy gives traders a disciplined way to enter and manage trades within trending markets. With EMA guidance and ATR-based volatility bands, it simplifies decision-making while protecting against emotional exits.

It’s ideal for traders who prefer structured setups with clear rules and visual confirmation.

FAQs

1. Can I use this strategy on all markets?

Yes. It works on forex, stocks, crypto, and commodities.

2. What timeframe gives the most reliable trends?

4-hour and daily charts are best for clean, sustained moves.

3. Should I use this strategy in sideways markets?

No. Wait for a confirmed trend before applying this setup.

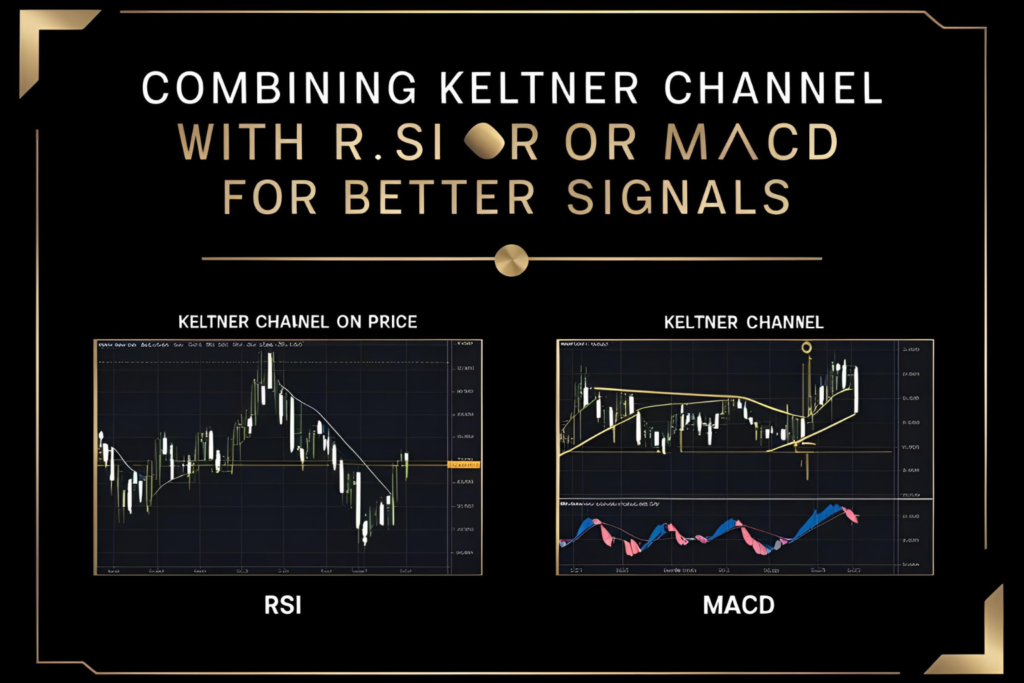

4. Can I combine this with RSI or MACD?

Yes. Use RSI for trend confirmation and MACD for momentum signals.

5. Does the trend-following method work better than breakouts?

Trend-following can be more reliable and profitable in steady markets, while breakouts work well in volatile or news-driven moves.